What the Revision Intends to Do

You very well may already be familiar with all that background; after all, if you are a commercial real estate professional or own investment property, this is as fundamental as the process of photosynthesis is to a botanist. The real pressing question is ultimately: why revise it?

Or as the colloquial saying goes: why fix something that ain’t broke? That depends on who you ask.

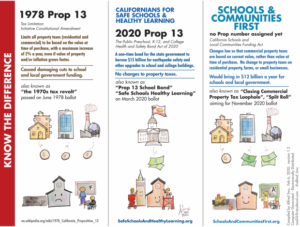

It ought to be noted that this is hardly the first time that the fundamental constitutionality and fairness of Prop 13 has been challenged; in fact, over the years, there have been close to two dozen attempts to modify it according to the Berkeley Research Group. This new “split roll” initiative, however, sets its eyes on a more substantial reform than any of the previous attempts and is poised to drastically alter California’s business and social landscape.

If passed, Prop 15 will require commercial and industrial properties to undergo regular ongoing assessments at least every three years in order to bring them to their current market value. Property owners will then pay property taxes on the newly assessed value. This excludes single family homes, multi-family complexes and agricultural land. Reassessment of mixed-use (residential and commercial) properties will operate on a proportionate basis where only the residential portion is exempt provided 75% or more of the property by square footage or value is residential. The original version of the proposed act was revised and replaced in recent months to loosen its already restrictive language to include an exemption for properties worth $3 million or less (up from $2 million in its previous iteration), changes its effective date from January 1, 2020 (for obvious reasons) to January 1, 2022 and eliminates the business personal property tax on the first $500,000 worth of business equipment.

Proponents of this measure argue that, despite the 1978 act making good on its intent to lessen the blow of property tax hits on homeowners, it’s been corporations with significant landholdings that have benefited most from Prop 13’s ubiquitous application across the board. An example often used in support of the measure is that of Google’s headquarter offices in Venice, CA where it currently leases over 100,000 square feet assessed at rates as low as $6 per square foot. Nearby parcels, however, are assessed at upwards of $300 per square foot. This is also true of Disneyland’s properties in Anaheim as they pay very little compared to the rising value of its property. Advocates for the new measure posit that this is fundamentally unfair.

They also argue that some businesses have exploited a loophole in the definition of a property transfer in which a business ensures that no partnership exceeds 50% control (either through corporate buy-outs or mergers) in order to avoid triggering a reassessment, estimating that upwards of a quarter of a billion dollars in new tax revenue are being missed out on annually. And yet others cite that some long held and underutilized commercial property such as parking lots and strip malls have circumvented reassessment by avoiding reconstruction or new ownership thus stagnating development. While there have been countless legislative attempts at closing the loophole, none have been successful.

And of course, the heart stirring impetus behind this new measure is that the estimated $12 billion in annual statewide revenue that will become available will, somehow, correct the state’s 41st overall ranking in the nation in per-pupil spending and, thus, improve education in California.

So simply put, the act proposes to create a split roll tax changing the current tax structure of commercial properties while leaving the tax structure for residential and agricultural properties untouched and give all that new tax revenue to schools.

Schools and Communities First, what the ballot measure is colloquially known as, is sponsored by a statewide coalition of over 300 social justice, faith-based, education, labor and philanthropic organizations but is principally funded by the San Francisco Foundation, a company owned by Facebook co-founder and CEO Mark Zuckerberg and his wife Priscilla Chan.

Tomorrow, we will look at why this measure is deceptively flawed and bad news for both the commercial real estate industry in California and the state economy as a whole.